Commercial License in Dubai: Requirements and Differences

Download

IFZA Official

Guides

-

Guide to obtaining a Dubai business license

Download the guide -

A UAE Business Owner’s Guide to Corporate Banking

Download the guide

Jump To What Interests You the Most:

- Why Is Corporate Tax Being Implemented?

- Should Free Zone Companies Register For Corporate Tax?

- When Is Corporate Tax Applicable For My Company?

- When Do I Need To Submit My Tax Return?

- Do I Need Financial Statements For My Tax Return?

- Are There Any Penalties For Non-Compliance?

- Are There Any Relief For Small Businesses?

- What Will My Free Zone Company Be Taxed On?

- How Much Corporate Tax Will I Have To Pay?

- Do I Need To Have My Financial Statements Audited?

- What Is A Qualifying Free Zone Person?

- What Is Adequate Substance?

- What Is Qualifying Income?

- What Are The Qualifying Activities?

- What Are The Excluded Activities?

- What Is The De Minimis Threshold?

- What Is The Deadline For Corporate Tax Registration?

- What Should I Do To Be Ready And Compliant For Corporate Tax?

Corporate Tax UAE

1. WHY IS CORPORATE TAX BEING IMPLEMENTED?

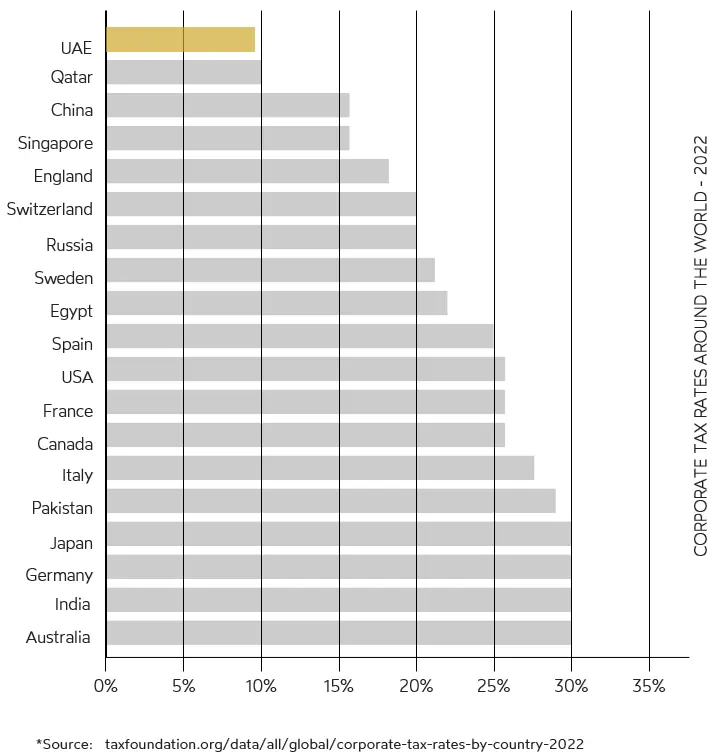

The UAE has introduced Corporate Tax to incorporate best practices and to initiate steps in meeting international standards on tax transparency and prevent harmful practices. The UAE Corporate Tax rate is still amongst the lowest rates globally.

2. SHOULD FREE ZONE COMPANIES REGISTER FOR CORPORATE TAX?

All Free Zone Companies are required to register for Corporate Tax, regardless of if they need to pay tax or not.

Companies will only need to file one Corporate Tax return each financial year and will not be required to make advance tax payments or prepare provisional tax returns.

For detailed guidance on how to register for Corporate Tax:

3. WHEN IS CORPORATE TAX APPLICABLE FOR MY COMPANY?

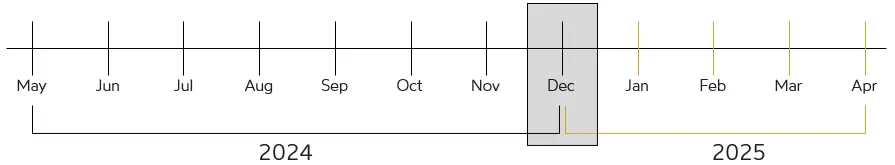

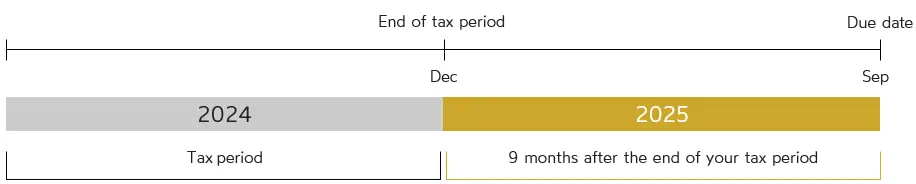

The new UAE Corporate Tax has come into effect for all financial years beginning on or after June 1st 2023.

The below illustrates when each financial year-end will be subject to UAE Corporate Tax (1st tax period):

Example from the illustration above:

If your Company’s financial year-end is December, then December 2024 will be its first financial year-end subject to tax.

The tax period will be for the preceding 12 months of the financial year-end date as noted above.

Your financial period and tax period will be the same, so ensure that you have documented your Company’s financial year-end through an approved Board Resolution.

4. WHEN DO I NEED TO SUBMIT MY TAX RETURN?

Your tax return submission will be due 9 months after the end of your tax period.

Example: December 2024 financial year-end:

Registration for Corporate Tax is required to be able to submit your tax return.

5. DO I NEED FINANCIAL STATEMENTS FOR MY TAX RETURN?

Financial statements are required to be prepared to substantiate the amounts in the tax return and therefore proper bookkeeping will be mandatory.

Important to note:

- If your revenue for the relevant tax period is AED 3 million or less, you can use the cash basis to prepare your financial statements.

- If your revenue for the relevant tax period is AED 50 million or less, then you can use IFRS for SME’s to prepare your financial statements.

- Otherwise – IFRS are required to be used for the preparation of the financial statements.

All accounting records should be kept for 7 years after the end of the tax period to which it relates.

6. ARE THERE ANY PENALTIES FOR NON-COMPLIANCE?

PENALTIES WILL BE APPLICABLE FOR INADEQUATE RECORD-KEEPING or the failure to

submit the required records and other information specified in the tax law.

FOR MORE DETAILS ON THE PENALTIES, DOWNLOAD THIS DOCUMENT

7. ARE THERE ANY RELIEF FOR SMALL BUSINESSES?

If your revenue for the tax period and previous tax period are below AED 3 million, you may be eligible to apply for Small Business Relief. You will then be eligible for 0% tax.

This relief is available until December 2026 and does not require audited financial statements.

Your financial statements can be prepared on a cash basis, which is a simplified method to prepare your financial records

Your annual tax return, will be a simplified tax return (not a full tax return)

You will be able to apply for the Small Business Relief during the submission of your first tax return.

8. WHAT WILL MY FREE ZONE COMPANY BE TAXED ON?

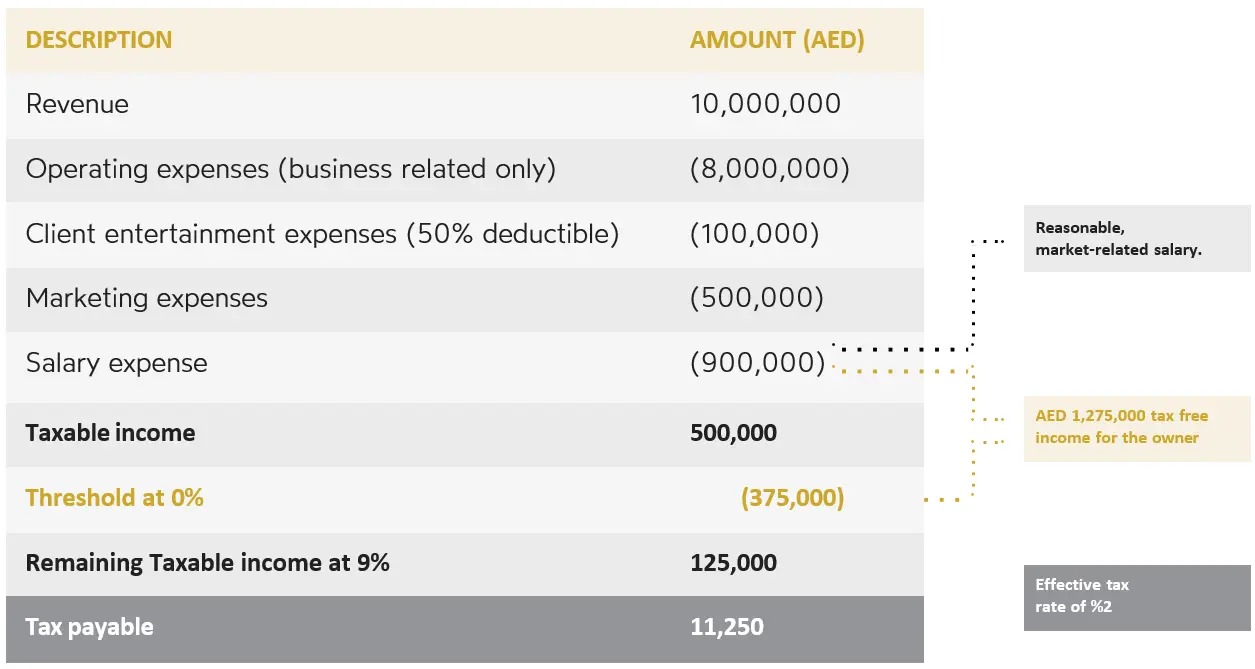

If your Free Zone Company does not meet the requirements of being a Qualifying Free Zone Person (refer to Question 11 for more details) then your Company will be taxed on its Taxable Income. The taxable income for a Tax Period will be the accounting net profit of the Company, after making adjustments for certain items specified in the Corporate Tax Law.

The accounting net profit is normally calculated as business income MINUS business expenses. All legitimate expenses are deductible in general. There is also an exemption on the first AED 375,000 net profit – which means that your Company will pay 0% tax on the first AED 375,000 profit.

No tax is levied on personal income (for example salary).

Companies are able to deduct the salaries that they pay to owners or employees when calculating their net profit.

9. HOW MUCH CORPORATE TAX WILL I HAVE TO PAY?

Corporate taxes can be lowered through various deductions and so the effective corporate tax rate – i.e., the rate a business pays – is usually much lower than the legal rate of 9%.

THE 9% IS ALSO ONLY APPLICABLE ON THE TAXABLE INCOME EXCEEDING AED 375 000.

EXAMPLE – EFFECTIVE TAX RATE

- The tax period is equal to the financial period.

- Penalties will be applicable for inadequate record-keeping or the failure to submit the required records and other information specified in the tax law.

10. DO I NEED TO HAVE MY FINANCIAL STATEMENTS AUDITED?

Financial statements are only required to be audited for Corporate Tax purposes, for the following categories:

- A Qualifying Free Zone Person (refer to Question 11)

- A Company deriving Revenue exceeding AED 50 million during the relevant Tax Period

11. WHAT IS A QUALIFYING FREE ZONE PERSON?

Not all Free Zone Companies will be a Qualifying Free Zone Person for Corporate Tax purposes.

The below requirements need to be met to be a Qualifying Free Zone Person:

- Registered in a Free Zone (FZCO)

- Maintains adequate substance in the State

- Earns qualifying income

- Has not elected to be subject to Corporate Tax

- Complies with Transfer Pricing regulations

- Maintain audited Financial Statements

- Non qualifying income should not exceed the “de minimis threshold”

12. WHAT IS ADEQUATE SUBSTANCE?

Maintaining adequate substance involves three important factors:

- Having adequate staff.

- Having adequate assets.

- Incurring adequate operating expenditure.

In simple terms, the Free Zone Company should not be a Free Zone Company on paper only.

As businesses vary, ‘adequate substance’ is determined on a case-by-case basis. The analysis should take into account the nature and level of activities performed by the Qualifying Free Zone Person, the Qualifying Income earned, and any other relevant facts and circumstances.

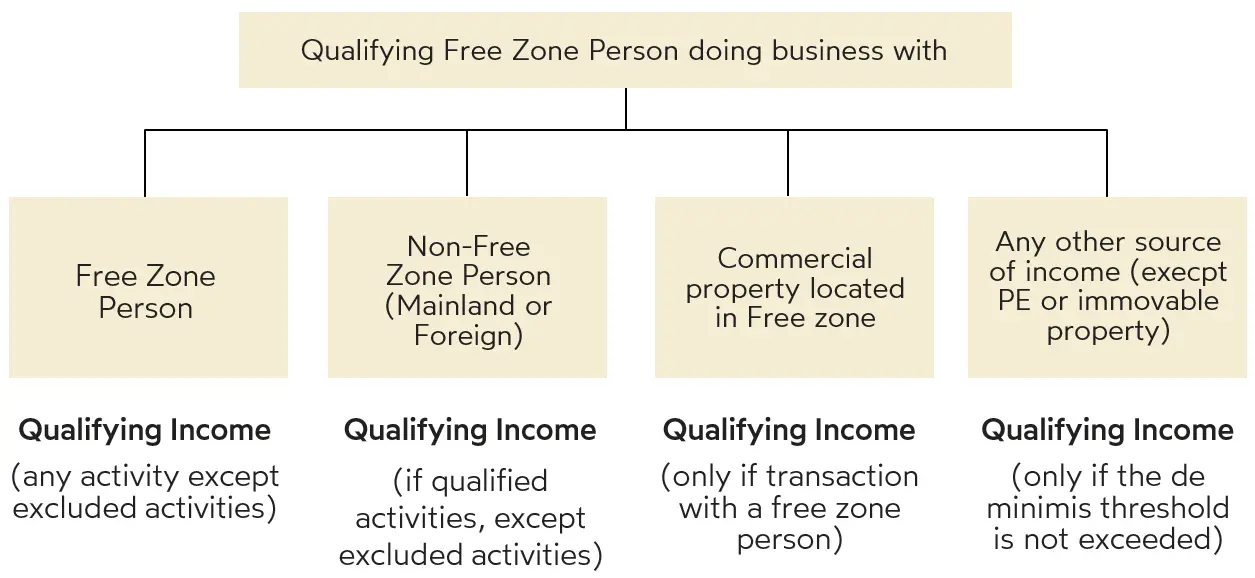

13. WHAT IS QUALIFYING INCOME?

Assess the following, to determine if a Company earns qualifying income:

- Who the Company does business with

- What type of business activity the Company is generating the income from

The below illustrates the high-level classification of qualifying income:

14. WHAT ARE THE QUALIFYING ACTIVITIES?

The below activities have been defined as qualifying activities:

- Manufacturing of goods or materials.

- Processing of goods or materials.

- Trading of Qualifying Commodities.

- Holding of shares and other securities for investment purposes.

- Ownership, management and operation of Ships.

- Reinsurance services.

- Fund management services.

- Wealth and investment management services.

- Headquarter services to Related Parties.

- Treasury and financing services to Related Parties.

- Financing and leasing of Aircrafts.

- Distribution of goods or materials in or from a Designated Zone.

- Logistics services.

- Any activities that are ancillary to some of these Qualifying Activities.

For more information, refer to the link here

15. WHAT ARE THE EXCLUDED ACTIVITIES?

- Transactions with natural persons, except some specific transactions related to ‘Qualifying Activities.

- Banking activities.

- Insurance activities, without prejudice to the ‘Qualifying Activities’ listed as reinsurance services and headquarters services.

- Finance and leasing activities without prejudice to some specific ‘Qualifying Activities’.

- Ownership or exploitation of immovable property, other than Commercial Property located in an FZ where the transaction in respect of such Commercial Property is conducted with an FZ Person.

- Any activities that are ancillary to the ‘Excluded Activities’ specified.

For more information, refer to the link here

16. WHAT IS THE DE MINIMIS THRESHOLD?

Non-qualifying income should not exceed the following:

Non-qualifying income is revenue derived from:

- Excluded Activities

- Non-Qualifying activities with a non-Free Zone Person

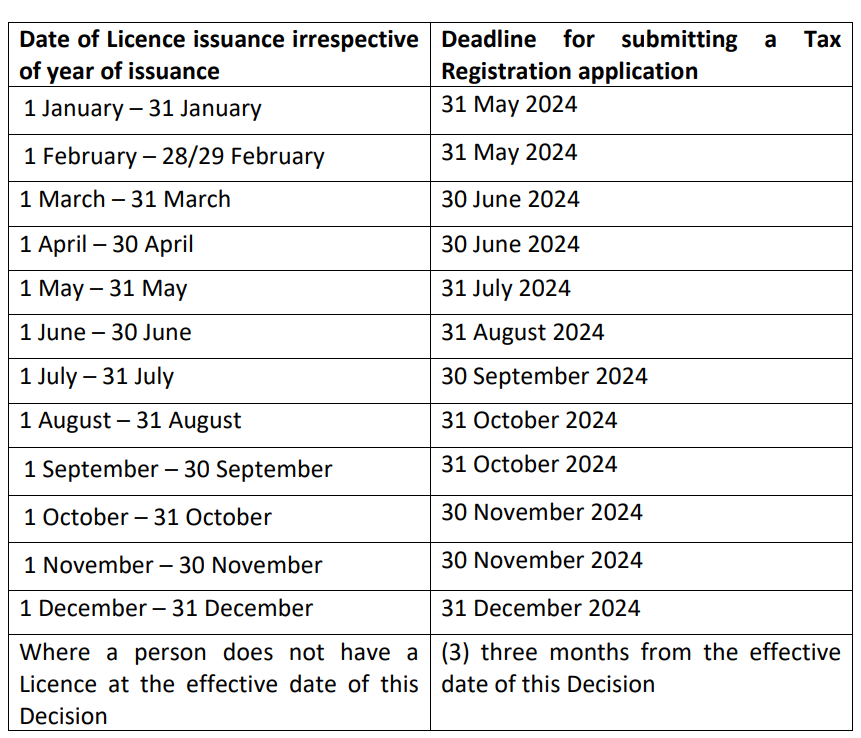

17. WHAT IS THE DEADLINE FOR CORPORATE TAX REGISTRATION?

UAE Federal Tax Authority has issued a new decision – Decision No. 3 of 2024 – effective from 1 March 2024, stipulating the deadlines for Companies to be registered for Corporate Tax.

The due date is dependent on the Company incorporation date as per the below:

Any Company incorporated/registered after 1 March 2024, will have a deadline of three (3) months from the date of incorporation, establishment, or recognition for submitting a Tax Registration application.

You will face AED 10,000 penalty if you fail to comply with these due dates.

For the full decision, refer to this link:

18. WHAT SHOULD I DO TO BE READY AND COMPLIANT FOR CORPORATE TAX?

Make sure:

- You are aware of when your first tax period will be;

- You know when your first tax return is due;

- You register for Corporate Tax before the deadline date as indicated

- You have proper accounting records to substantiate your Small Business Relief application;

- You have proper accounting records to substantiate your tax return;

FOR MORE INFORMATION

Visit The Ministry of Finance Website for a List of Frequently Asked Questions