Commercial License in Dubai: Requirements and Differences

Download

IFZA Official

Guides

-

Guide to obtaining a Dubai business license

Download the guide -

A UAE Business Owner’s Guide to Corporate Banking

Download the guide

Jump To What Interests You the Most:

- When was Value Added Tax (VAT) implemented?

- Should Free Zone companies register for VAT?

- When is VAT applicable for my company?

- Are there any exemptions for VAT registration?

- Which period will my VAT submission cover?

- When do I need to submit my VAT return?

- Are there any penalties for non-compliance?

- What is the requirement to issue an invoice once a company is registered for VAT?

- How does VAT work?

- What are taxable supplies?

- What should I do to be ready and compliant for VAT?

VALUE ADDED TAX (VAT) FAQ

1. WHEN WAS VALUE ADDED TAX (VAT) IMPLEMENTED?

The UAE introduced the Value Added Tax (VAT) in 2018 as a new source of income for the government to provide high-quality services to the public and maintain the standard of living in the country.

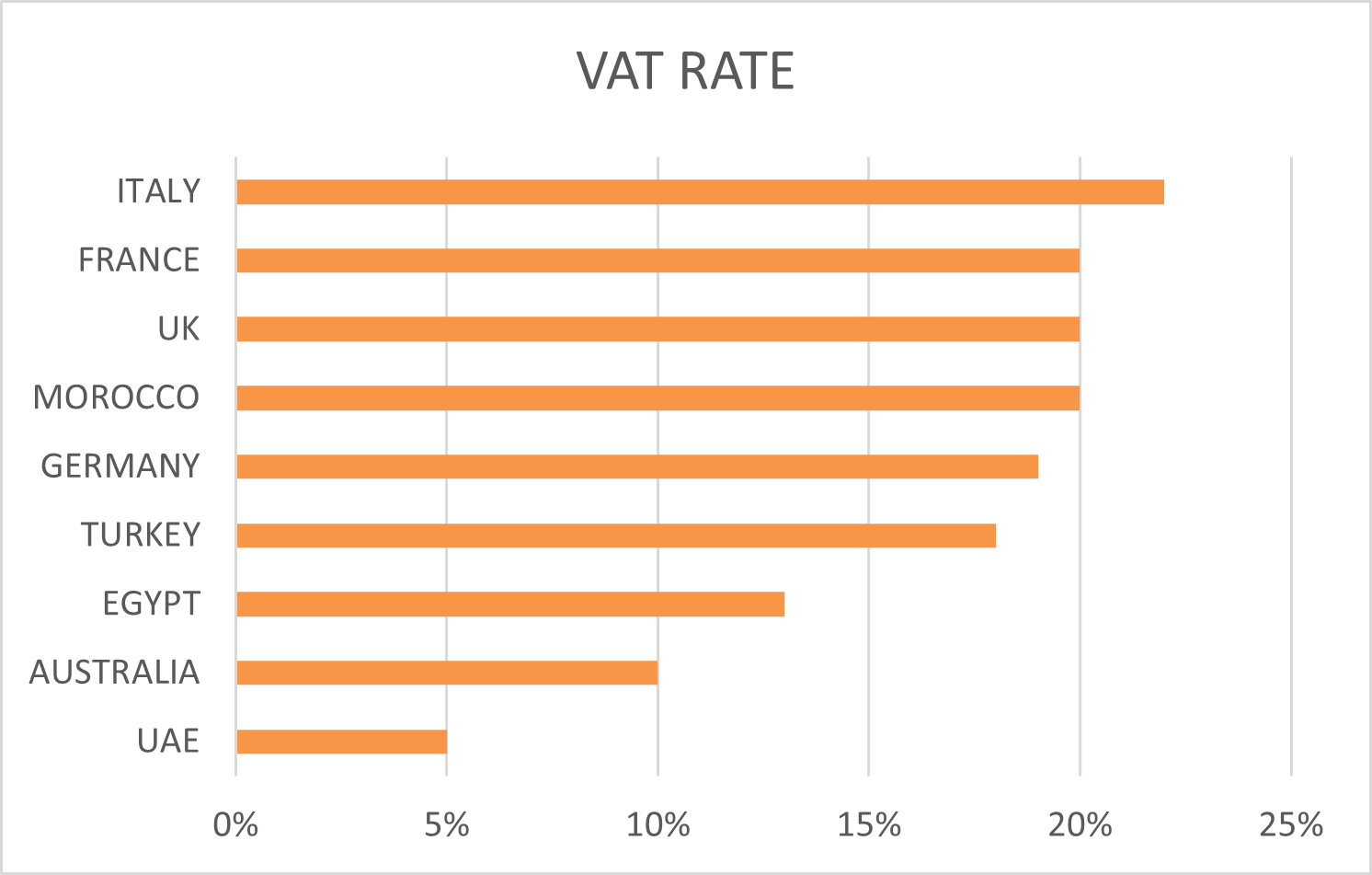

From the chart seen below UAE has one of lowest VAT rates in the world:

*Source:

https://www.researchgate.net/figure/VAT-rates-in-various-countries_fig2_333511632

2. SHOULD FREE ZONE COMPANIES REGISTER FOR VAT?

Free Zone Companies are required to register for VAT when the following conditions are met:

- Mandatory Registration

All UAE-resident businesses who make taxable supplies in the UAE must mandatorily register for VAT provided the total value of its taxable supplies** and imports (into the UAE) exceed the mandatory threshold of AED375,000 either during the last 12 months or is expected to exceed this threshold within the upcoming 30 days.

Non UAE-resident businesses who make taxable supplies in the UAE must also mandatorily register for VAT, regardless of the value of its taxable supplies and imports, where there is no other person obligated to pay the due tax on these supplies in the UAE.

- Voluntary Registration

A UAE-resident business can voluntarily register if they do not meet the mandatory threshold for VAT and the total value of its taxable supplies** and imports or taxable expenses (within the UAE) exceed the voluntary threshold of AED187,500 either during the last 12 months or is expected to exceed this threshold within the upcoming 30 days.

*Source: https://tax.gov.ae/en/taxes/Vat/vat.topics/registration.for.vat.aspx

**A taxable supply refers to a supply of goods or services made by a business in the UAE that may be taxed at a rate of either 5% or 0%. Imports are also taken into consideration for this purpose, if a supply of such goods or services would be taxable if made within the UAE.

Source: https://tax.gov.ae/DataFolder/Files/Pdf/VAT-Decree-Law-No-8-of-2017.pdf

Once the VAT Registration is approved by the Federal Tax Authority (FTA) a Tax Registration Number (TRN) will be issued.

*Source: https://tax.gov.ae/en/taxes/Vat/vat.topics/filing.vat.returns.and.making.payments.aspx

For detailed guidance on how to register for Value Added Tax:

Federal Tax Authority – VAT Registration

3. WHEN IS VAT APPLICABLE FOR MY COMPANY?

When the company meets the mandatory threshold (mentioned above) of AED375,000, the company needs to register within 30 days of meeting the threshold.

If this deadline is not met, the FTA will charge the Late Registration and consecutively the Late VAT Filing penalty.

4. ARE THERE ANY EXEMPTIONS FOR VAT REGISTRATION?

As per Article 16 of the Regulations, the FTA may except a Taxable Person from Mandatory Tax Registration upon the request if all the company’s supplies are only subject to Zero-Rate Tax.

Once the company applies for VAT Exception and it is accepted by the FTA (after the settlement of VAT previously due and settlement of administrative penalties), the taxable person should notify the FTA (within ten business days) if they start making standard-rated supplies as then the VAT Registration Exemption would change.

Kindly contact a tax consultant in the UAE to apply for the VAT Exception.

Also note the VAT Exception is given fully on the discretion of the Federal Tax Authority, the FTA has the full authority to accept or reject the VAT Exception.

If the FTA denies the VAT Exception, the company needs to Register for VAT. Once the company makes the taxable supply in the UAE, they will no longer be able to keep its VAT Exception Status.

5. WHICH PERIOD WILL MY VAT SUBMISSION COVER?

For companies, whose revenue is below AED150million the VAT period will be quarterly.

For companies, whose revenue is above AED150million the VAT period will be monthly.

The FTA will determine your VAT period, and this will be identifiable on your VAT certificate once you are registered.

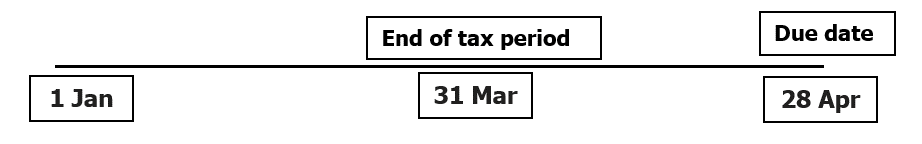

The VAT return is required to be submitted within 28 days of the end of the VAT period.

Example of quarterly submission: If your quarter is from January-March 2024, then you need to file your VAT for the period by no later than 28th April 2024.

Registration for VAT is required to be able to submit your VAT return.

6. WHEN DO I NEED TO SUBMIT MY VAT RETURN?

Once the VAT Registration is approved by the FTA, a Tax Registration Number will be issued.

Companies will only need to file VAT Returns quarterly if their annual turnover is below AED150 Million and otherwise monthly within 28 days from the end of the relevant tax period.

*Source: https://tax.gov.ae/en/taxes/Vat/vat.topics/filing.vat.returns.and.making.payments.aspx

7. ARE THERE ANY PENALTIES FOR NON-COMPLIANCE?

Penalties will be applicable for late VAT registration, inadequate recordkeeping, late VAT filing, etc.

TAXP001 – Amendment of Penalties – 27 05 2021.pdf

8. WHAT IS THE REQUIREMENT TO ISSUE AN INVOICE ONCE A COMPANY IS REGISTERED FOR VAT?

The company’s TRN issued by the FTA should be included in the Tax Invoice that the taxable person issues to their customer when goods are sold, or services are rendered.

There are specific requirements to be met when issuing invoices as a Taxable Person.

Refer to the details here: 06-Tax-Invoices.pdf

9. HOW DOES VAT WORK?

Taxable persons can calculate the “Tax Liability” or tax to be paid by deducting Input VAT from Output VAT.

Input VAT is the tax claimable when the taxable person purchases goods/services from a supplier who is tax registered and has a TRN. Please note that if the amount as per the Tax Invoice is paid partly then only the equivalent amount can be recoverable as Input Tax/Input VAT.

Output VAT is the tax that the taxable person charges on the goods sold/services rendered to the customer. This VAT can only be charged if the taxable person has a TRN issued by the FTA. Depending on the place of supply, the taxable person charges the Output VAT/Output Tax.

VAT Payable = Input VAT – Output VAT

Please note that if the Input VAT (i.e., VAT on purchases) is more than the Output VAT (i.e. VAT on sales) then the taxable person can claim back VAT in the form of a VAT Refund.

10. WHAT ARE TAXABLE SUPPLIES?

Taxable supplies refer to the supply of goods or services made by a business in the UAE that may be taxed at a rate of either 5% or 0%.

The supplies made outside UAE (exports) are also included in computation and therefore, in case your exports value exceed the mandatory threshold of AED 375,000 annually, you would need to register your business under VAT. The exports may be charged at a 0% VAT rate but the same needs to be reported to the FTA on return.

| VAT on Sales and all other outputs | AMOUNT (AED) | VAT AMOUNT (AED) | ADJUSTMENT (AED) |

| 1(a). Standard Rated Supply in Abu Dhabi | |||

| 1(b). Standard Rated Supply in Dubai | |||

| 1(c). Standard Rated Supply in Sharjah | |||

| 1(d). Standard Rated Supply in Ajman | |||

| 1(e). Standard Rated Supply in Umm Al Quwain | |||

| 1(f). Standard Rated Supply in Ras Al Khaimah | |||

| 1(g). Standard Rated Supply in Fujairah | |||

| 2. Tax Refunds | |||

| 3. Supply subject to reverse charge | |||

| 4. Zero Rated Supply | |||

| 5. Exempt Supplies | |||

| 6. Import VAT through Customs | |||

| 7. Adjustments to Goods imported in to the UAE | |||

| 8. Total | |||

| VAT on expenses and all other inputs | |||

| 9. Standard Rated Expenses | |||

| 10. Supplies Subject to Reverse Charge | |||

| 11. Total | |||

| Net VAT Due | |||

| 12. Total Value of due TAX for the period | |||

| 13. Total Value of recoverable tax for the period | |||

| 14. Payable tax for the period | |||

11. WHAT SHOULD I DO TO BE READY AND COMPLIANT FOR VAT?

Make sure:

- You are aware of your total taxable supplies for the 12-month period (>AED375,000)

- You are aware whether you need to register for VAT or not.

- You know when your first VAT return is due.

- You have proper accounting records to substantiate for the VAT due/refund.

Visit the Ministry of Finance website for more information: VAT – Ministry of Finance – United Arab Emirates (mof.gov.ae)