Starting a business? Don’t forget these five important things

If there’s one thing that’s taking center stage in the UAE, it’s the introduction of the new corporate tax laws. The recent changes have left many business owners and executives feeling overwhelmed and unsure of how to navigate the new regulations. But don’t worry, we’re here to help. In this blog, we’re going to break down everything you need to know about UAE Corporate Tax, specifically addressing all your frequently asked questions.

We know that taxes aren’t the most exciting topic, but they are important. By understanding the new laws, you’ll be able to make informed decisions for your business and ensure compliance.

Why Are Taxes Being Introduced on Corporate Income?

The UAE is introducing taxes on corporate income to:

- Enhance its status as a leading commercial and investment destination.

- Accelerate its development to achieve strategic objectives.

- Comply with international standards of tax transparency.

- Eliminate any harmful tax practices.

- Reduce its reliance on oil revenue.

How Does UAE Corporate Tax Compare to Other Countries?

With Australia at 34%, the United Kingdom at 25%, and Singapore at 15%, UAE has one of the lowest corporate taxes in the world.

What Is the Minimum Threshold to Pay Corporate Tax?

Corporate tax will be levied at a rate of 9% on taxable income exceeding AED 375,000.

What Is Emara Tax?

Emara Tax is a digital platform launched by the Federal Tax Authority (FTA) in the United Arab Emirates to enable taxpayers to pay their tax obligations, obtain refunds, and access related services securely and conveniently.

Who Will Be Subject to UAE CT?

According to the Ministry of Finance (MOF), UAE CT will apply to those juridical who are incorporated or managed and controlled in the UAE. This also applies to foreign juridical persons that have a permanent establishment in the country.

Individuals will be subject to CT if they are engaged in any business activity in the UAE, directly or through a sole proprietorship/unincorporated partnership. A Cabinet Decision will be issued in due course specifying further information on what would bring an individual (legally known as a “natural person”) within the scope of UAE CT.

Will UAE Entities Owned by UAE Or GCC Nationals Be Subject to UAE CT?

Yes, according to MOF entities owned by UAE or GCC nationals will also be subject to UAE CT. The CT will be applied whether the juridical person is incorporated, is a resident of the UAE, or has a permanent establishment in the country.

What UAE CT Rates Will Apply to Entities Established in A Free Zone?

For entities established in a Free Zone, the UAE CT rates that apply are:

- 0% on Qualifying Income

- 9% on Taxable Income that does not meet the Qualifying Income definition

It is important to note that the 0% Free Zone CT regime is not automatically applied, a Qualifying Free Zone Person that meets the relevant conditions will be able to benefit from the 0% Free Zone CT regime automatically. They can also choose to not apply the Free Zone CT regime and instead, be subject to the standard CThere are specific conditions set by the FTA regarding Free Zone entities. For the latest information, go to mof.gov.ae

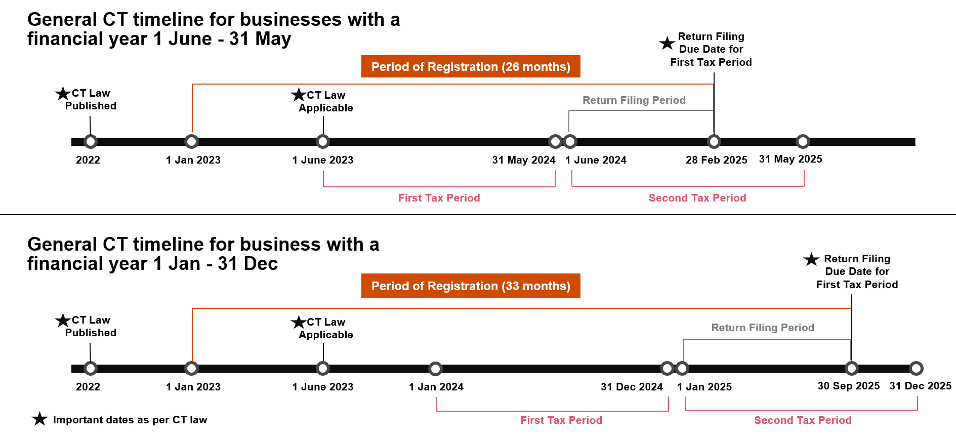

When Will the Corporate Tax Come into Effect?

The corporate tax will come into effect from the beginning of their first financial year which starts on or after June 1, 2023.

If your company’s fiscal year starts on June 1st, 2023, and ends on May 31st, 2024, you will be subject to CT starting June 1st, 2023, and your first tax return filing will be due in the end of 2024. If your company’s fiscal year starts on January 1st, 2023, and ends on December 31st, 2023, CT will start on January 1st, 2024 and filing will be due in mid-2025.

Will Companies Be Invited to Register on Emara Tax?

According to MOF, early registration will be from January to May 2023 for certain categories of companies. The selected companies will receive an email or SMS from the FTA inviting them to register via the Emara Tax platform. FTA is yet to announce registration for other companies and businesses will open. When the registration begins, companies and businesses that have a financial year starting on 1st June 2023 will be given priority.

Will You Still Have to Pay VAT with CT in the UAE?

CT and Value-Added Tax (VAT) are separate taxes that will both be in effect in the UAE. If you are a registered business for VAT, you will have to pay both taxes separately. If your business is not registered for VAT, you may still have to pay CT.

How Can You Prepare for Corporate Tax?

To prepare for Corporate Tax, it is important to take the following steps:

- Familiarize yourself with the Corporate Tax Law and any additional information provided by the Ministry of Finance and the Federal Tax Authority.

- Use the information available to determine if your business is subject to Corporate Tax and when it will be effective.

- Understand the specific requirements for your business, such as the need to register, the accounting/tax period, the filing deadline, and any necessary elections or applications.

- Keep track of any updates or guidance provided by the Ministry of Finance and the Federal Tax Authority.

- Keep all the financial information and records that are required for Corporate Tax purposes.

As Dubai’s most dynamic and truly international Free Zone, IFZA is committed to supporting the community’s compliance with the latest regulation. We began the implementation of several activities that aimed to empower members to face the upcoming changes to our business ecosystem. If you have any questions stay tuned to our website for future additions of CT-related knowledge events.