Dubai General Trading License: Full Guide

Download

IFZA Official

Guides

-

How to become an IFZA professional partner

Download the guide -

Company formation in Dubai (2023): an insider’s guide

Download the guide

General Trading License In UAE

Types of Licenses:

A professional services license is suitable for businesses that offer professional services. On the other hand, a commercial license is necessary for businesses that trade in goods.

https://youtu.be/8kSGLyyjT1Y

Specific License Types:

Within these categories are specific license types that are tailored to meet different business needs. If your business deals with various goods, a general trading license may be suitable. This type of license enables you to trade in a diverse range of goods, from food and clothing to toys and electronic parts, all under one license. Applying for a general trading license in Dubai is a straightforward process. Here’s everything you need to know:

General Trading License in Dubai – All you need to know:

- What Does General Trading Mean

- What Is A General Trading License

- What Start A General Trading Company In Dubai

- How To Get A General Trading License In Dubai?

- What Are The Documents Required For A General Trading License In Dubai?

- General Trading License In Dubai: Mainland Vs Free Zones

- Can A Business With An IFZA General Trading License Sell Products On Dubai Mainland?

- What’s The Difference Between A Trade License And A General Trading License In Dubai?

- Do You Have To Live In Dubai To Open A General Trading Business There?

- Get Your General Trading License In Dubai With IFZA

What Does General Trading Mean?

General trading in the United Arab Emirates (UAE) involves the import, export, and trade of various goods and products. It encompasses the trading of a wide range of physical products, including but not limited to furniture, electronics, clothing, toys, and industrial equipment. However, it is important to note that there are restrictions on certain products such as cars, alcohol, medical products, and weaponry, and a specific license is required to import or export them.

What Is a General Trading License?

It’s important to note that a ‘general trading license’ is not the same as a ‘trading license.’ While a trading license only permits you to trade within a single product category of an industry, a general trading license allows you to trade in multiple products across various industries.

Why Start a General Trading Company in Dubai?

Setting up a general trading company in Dubai comes with a host of benefits and opportunities, making it a smart business decision for any entrepreneur. Here are some of the top reasons to consider starting your general trading business in Dubai:

-

01.Local and International Trade

Obtaining a general trading license in Dubai allows you to import or manufacture all goods listed in the license. This means you can distribute these goods in Dubai’s local market or export and re-export them to profitable countries.

-

02.Low Tax Rate

The fact that the UAE has one of the world’s lowest tax rates makes it one of the best incentives to start a business in Dubai. With a general trading license in Dubai, you can manufacture products at the lowest possible cost.

-

03.Wide Range of Products

With a general trading license in Dubai, you can trade a wide range of products, except for a few restricted products or sensitive materials. The initial high fees for the license pay off with ongoing benefits for several years to come.

-

04.Simple Process

The process of obtaining a general trading license in Dubai is both profitable and easy. You can get your trading license from DET after submitting the required documents in just one week, unlike several other long registration processes.

-

05.Easy Sponsorship for Dependents

The general trading license also offers investors the advantage of making it easier for their employees and dependents to apply for visas. By sponsoring their dependents, these traders can obtain UAE visas more easily.

-

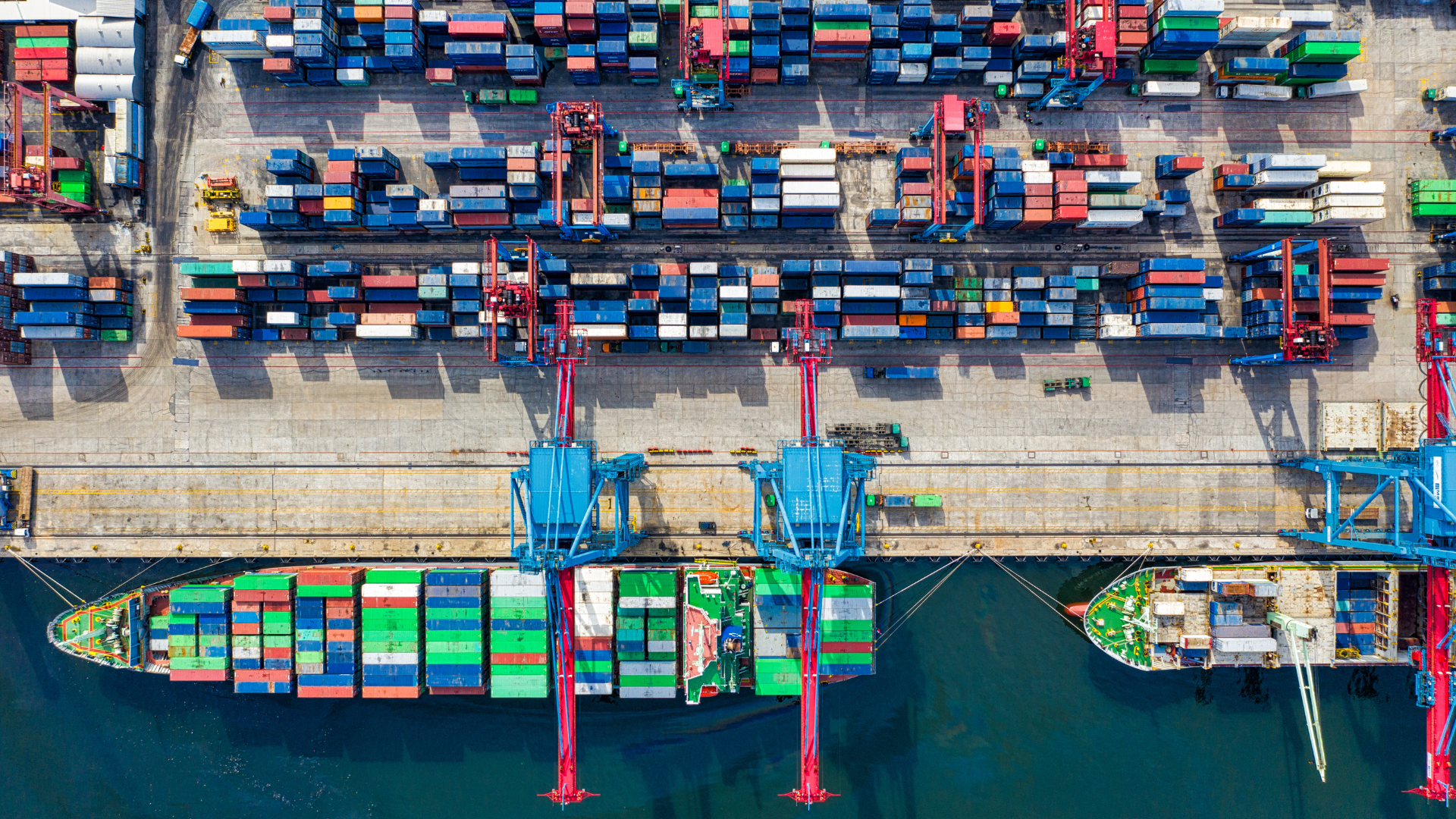

06.Center of Global Trade

Dubai’s geographical position at the center of the global map for world trade means you will have many opportunities to make your business a success.

-

07.World-Class Infrastructure

Dubai has world-class infrastructure for your company, including warehouses, logistics businesses, excellent seaports and airports, and a smooth customs process.

-

08.Business Networks and Support Services

There are many businesses in the UAE that can provide support services for your trading company, offering things like logistics, warehousing, legal, marketing, finance, and much more.

-

09.Business-Friendly and High Demand

The Dubai government is business-friendly and has fostered an environment that makes general trading smooth and transparent. The country’s population is also wealthy, and the UAE has a booming economy, which means you can be confident the products you import will find a market.

How To Get a General Trading License in Dubai?

Getting a general trading license in Dubai involves several steps that are important to follow.

General Trading License in Dubai Steps:

- Step 1: Choose Your Jurisdiction

Dubai offers two primary jurisdictions for businesses – Mainland and Free Zones.

Mainland companies are regulated by the Dubai Department of Economy and Tourism (DET) and are required to have a UAE national as a partner or sponsor. On the other hand, Free Zones are designed to offer foreign investors 100% ownership of their business, without the need for a local partner.

Free Zones like IFZA are particularly attractive to traders and investors as they offer several benefits, including low tax rates, 100% repatriation of capital and profits, easy business setup procedures, and simplified business regulations. Additionally, Free Zones offer businesses access to state-of-the-art infrastructure, modern communication systems, and world-class logistics facilities, making them an ideal location for international trade.

Dubai has over 30 free zones, each designed to cater to specific industries, such as technology, media, healthcare, and logistics. When choosing a Free Zone, it’s essential to consider factors such as location, infrastructure, cost, and the types of licenses available.

While both Mainland and Free Zone jurisdictions have their advantages, Free Zones are particularly attractive to traders due to their favorable regulations and business-friendly environment. With the right jurisdiction, businesses can enjoy the benefits of a general trading license in Dubai and thrive in the emirate’s growing economy.

- Step 2: Choose A Company Name

Choose a name for your general trading business and send it for initial approval. Make sure to read the guidelines for naming a company in Dubai. Once your name is approved, you can apply for a general trading license in Dubai.

Some of the rules are as follows:

- The name will be transliterated into Arabic or English and can’t contain special characters or icons.

- Offensive, blasphemous, or brand names are not allowed, nor are words related to religion, countries, or regions.

- The name cannot start with certain words, such as “Universal” or “International.”

- The database checks for duplicate names in both languages.

- Trade names can be categorized into premium categories A and B.

- The name must not contain obscene words or offend public decency.

- Using names of countries or governments requires embassy approval.

- The name is valid for six months and must be renewed.

- Trademarks are registered with the Ministry of Economy.

- A franchise can use a trade name if the contract is submitted to the Department of Economic Development.

- Failure to obtain a trade license will result in the cancellation of the trade name.

- The department of Economic Development can cancel or change a trade name if it violates terms and conditions.

- Fees must be paid within 72 hours of payment authorization issuance.

- Step 4: Secure Office Space

Since general trading involves physical goods, you might need to rent an office space for storage.

- Step 5: Obtain Customs Clearance

Obtaining customs clearance is a primary obligation for any business that imports goods into the country. To do this, you must obtain an import code from the customs authority and pay the applicable fee. You can register with any customs authority in the emirates.

What Are the Documents Required for a General Trading License in Dubai?

If you plan to form a company with individual shareholders, you will need to provide the following:

- A copy of your passport

- Passport-size photo

- Copy of your residence visa

- Copy of your Emirates ID

These documents are necessary to verify your identity and residency status in Dubai.

On the other hand, if you plan to form a trading company with corporate shareholders, you will need to provide the following:

- Certificate of incorporationThis is a legal document that confirms the creation of the company and its registration with the relevant government authority.

- Certificate of incumbency or equivalentThe certificate of incumbency or equivalent is a document that lists the current shareholders, directors, and officers of the company.

- Memorandum of associationThe memorandum of association is a legal document that outlines the objectives, powers, and rules of the company.

- Board resolutionThe board resolution is a document that authorizes the company to engage in general trading activities and approves the application for a general trading license.

These documents are necessary to verify the legal existence of the company and the authorized signatories who can act on behalf of the company.

It’s important to note that these documents may vary depending on the jurisdiction where you plan to set up your general trading company in Dubai. Additionally, you may need to provide additional documents or undergo additional procedures, such as getting your documents attested by the relevant authorities or obtaining a no-objection certificate from your current employer if you are working in Dubai on a residency visa.

Our global network of Professional Partners assisted by the experts at IFZA will ensure that you have all the necessary documents and to guide you through the process of opening a general trading company in Dubai.

General Trading License in Dubai: Mainland Vs Free Zones

Dubai offers two options for obtaining a General Trading License: through Dubai Economy or Dubai Free Zones. Each option offers various benefits and costs.

General Trading License in Dubai – Mainland

For investors looking to open a wholesale and retail business in mainland Dubai, obtaining a General Trading License from Dubai Economy is the ideal choice.

Instant License Option

Dubai Economy offers an Instant License with a one-year validity that does not require office space. However, after one year, the investor must renew the license by securing physical office space for the company to conduct trade in and outside the UAE.

Advantages of Mainland General Trading License Dubai

Mainland is one of the most preferred locations among investors due to its flexibility and ability to scale up the trading company.

Key advantages of obtaining a General Trading License from Dubai Mainland:

- Allows entrepreneurs to be actively involved in local trading in the UAE market

- No restriction on the number of visas and employment visas, depending on the office space acquired.

- Easy company formation in UAE Mainland, with LLC Company Structure being the most chosen by investors.

- Finding a local sponsor for LLC company can be easy by taking assistance of Business Consultants.

General Trading License in Dubai Free Zones

The Free Zones of UAE offer easy and smooth company formation process. IFZA offers exclusive general trading license packages that suit all investors requirements.

The General Trade License enables investors to facilitate international trade easily due to the advanced logistics and warehouse support available at the Free Zones.

- 100% foreign ownership

- Total control of Business

- Fixed fee for the term of the license

- 100% repatriation of profits

- Customs duty exemption

Can A Business with an IFZA General Trading License (Free Zone) Sell Products on The Dubai Mainland?

IFZA general trading companies are required to establish a partnership with a local distributor holding a mainland license, who will handle all aspects of delivery and fulfilment for transactions on the Dubai mainland. This ensures that businesses with an IFZA general trading license can still effectively operate and reach customers in Dubai while complying with local regulations.

What’s The Difference Between a Trade License and A General Trading License in Dubai?

In the UAE, businesses must obtain a license before engaging in any commercial activity. Two types of licenses commonly issued are general trading licenses and trade licenses. Although they sound similar, there are key differences between them.

Difference between general trading license and trade license in Dubai:

- General Trading License in DubaiA general trading license allows businesses to retail and wholesale any goods within the UAE and outside the UAE, except prohibited goods that require approval from authorities.

- Scope of General Trading License in DubaiThe scope of a general trading license in Dubai is large and wide enough compared to a trading license. This means that businesses with a general trading license can trade in any type of goods that are not exempted, including import and export activities.

- Trade LicenseA trade license, on the other hand, is limited to specific types of goods registered under the license. Businesses with a trade license can only trade in goods that are specified in the license. Any other goods available in the market cannot be traded without being registered under the license.

- Scope of Trade LicenseThe scope of a trade license is limited to the specific type of goods mentioned in the license. For instance, if a business has a trade license for selling clothes, they cannot sell any other product without obtaining another license.

Do You Have to Live in Dubai to Open a General Trading Business There?

In the past, foreign business owners needed to have a local sponsor or partner to open a business in Dubai or anywhere in the UAE. However, in recent years, the UAE government has made significant changes to its foreign ownership laws, making it possible for foreign business owners to own 100% of their business in some specific areas, such as Free Zones.

This means that if you want to open a business in a Free Zone in Dubai, you do not have to be a resident or citizen of the UAE. You can operate your business remotely or hire someone to manage it on your behalf. This is because Free Zones are designed to attract foreign investment by offering incentives such as simplified incorporation procedures.

On the other hand, if you want to open a business outside the Free Zones, you still need a local sponsor or partner to own 51% of the business, while you can only own 49%. However, in some specific sectors, such as technology, healthcare, education, and renewable energy, foreign investors can now own 100% of the business without the need for a local partner.

The rules and regulations for foreign ownership vary depending on the location and sector you choose to invest in. However, if you decide to invest in a Free Zone, you can enjoy 100% foreign ownership, which means you have complete control over your business operations.

Get Your General Trading License in Dubai with IFZA

IFZA is a truly International Free Zone and renowned for General Trading Licenses in Dubai. Our streamlined processes and international network of Professional Partners make it easy for you to apply for an ecommerce license without the need to physically be present in the UAE.

Our focus is on providing entrepreneurs like you with a hassle-free process of setting up your business in Dubai. With an IFZA general trading license in Dubai, you can choose from thousands of business activities and combine Commercial and Professional activities under a single license. Our Free Zone ecosystem provides ongoing support for your business, including assistance with corporate bank account opening and medical insurance coverage.

Take the first step towards success in launching your ecommerce business in Dubai today. Contact an IFZA Professional Partner to learn more about obtaining a general trading license in Dubai with IFZA.