Types of Business Licenses in Dubai: Exploring Different Categories

BUSINESS SETUP CHALLENGE #1: CHOOSING THE RIGHT LOCATION

When setting up a business in the UAE, you will need to choose the right location for your business. There are two main options: Free Zones and the Mainland.

Free Zones offer several advantages for businesses, including:

- Lower taxes: Free Zones offer a number of tax breaks and exemptions, which can save businesses a significant amount of money.

- Incubators of FDI: Free Zones are known for their liberal legal infrastructure which drives foreign direct investment.

- Greater flexibility: Free Zones offer more flexibility in terms of the types of businesses that can be set up and the way that businesses can operate.

If you are targeting private or public companies that require their business partners to be in the same jurisdiction, then you will need to make sure that your business is located in the same jurisdiction as your target audience. This is because these companies may have specific regulations or requirements that need to be met in order to do business with them.

Solution:

The best choice of location for your business will depend on your specific needs and circumstances. If you are unsure which option is right for you, speak to a business advisor who can help you assess your needs and make the best decision for your business.

BUSINESS SETUP CHALLENGE #2: FINDING AN OFFICE SPACE

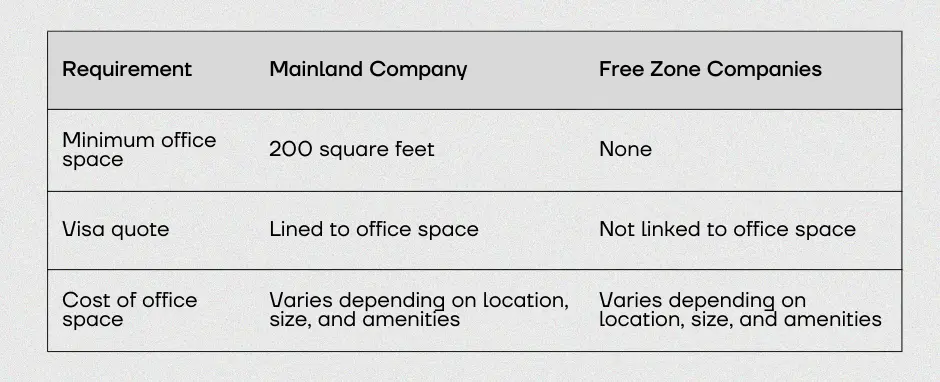

In the UAE, a company license must always be linked to a physical office space, making finding suitable premises a crucial step. Different jurisdictions have varying requirements for minimum office space, often linked to the visa quota or allowance for the company.

According to the Department of Economic Development (DED), each mainland company must lease a business facility. The minimum office space requirement set by DED is to lease a minimum of a 200 square foot office.

Mainland companies have also been allocated a quota for the number of employees that they can hire for their company. This quota depends on the area the company has taken as their operational premises.

The cost varies depending on the location, size, and amenities of the space. For example, a 200 square foot office in Downtown Dubai can cost around AED 100,000 per year.

Free zone companies on the other hand, do not have the same minimum office space requirements as mainland companies. In fact, some Free Zones do not require certain company categories to have office space at all. This can be a major advantage for businesses that are looking to save money on office space.

Solution:

IFZA has waived the office space requirement for companies with less than 4 visa allocations in their license. For those who require office space, IFZA offers flexible desk solutions or private office spaces. You can also consult with business setup professionals to help navigate the process and find cost-effective solutions.

BUSINESS SETUP CHALLENGE #3: UNDERSTANDING THE TAX ENVIRONMENT

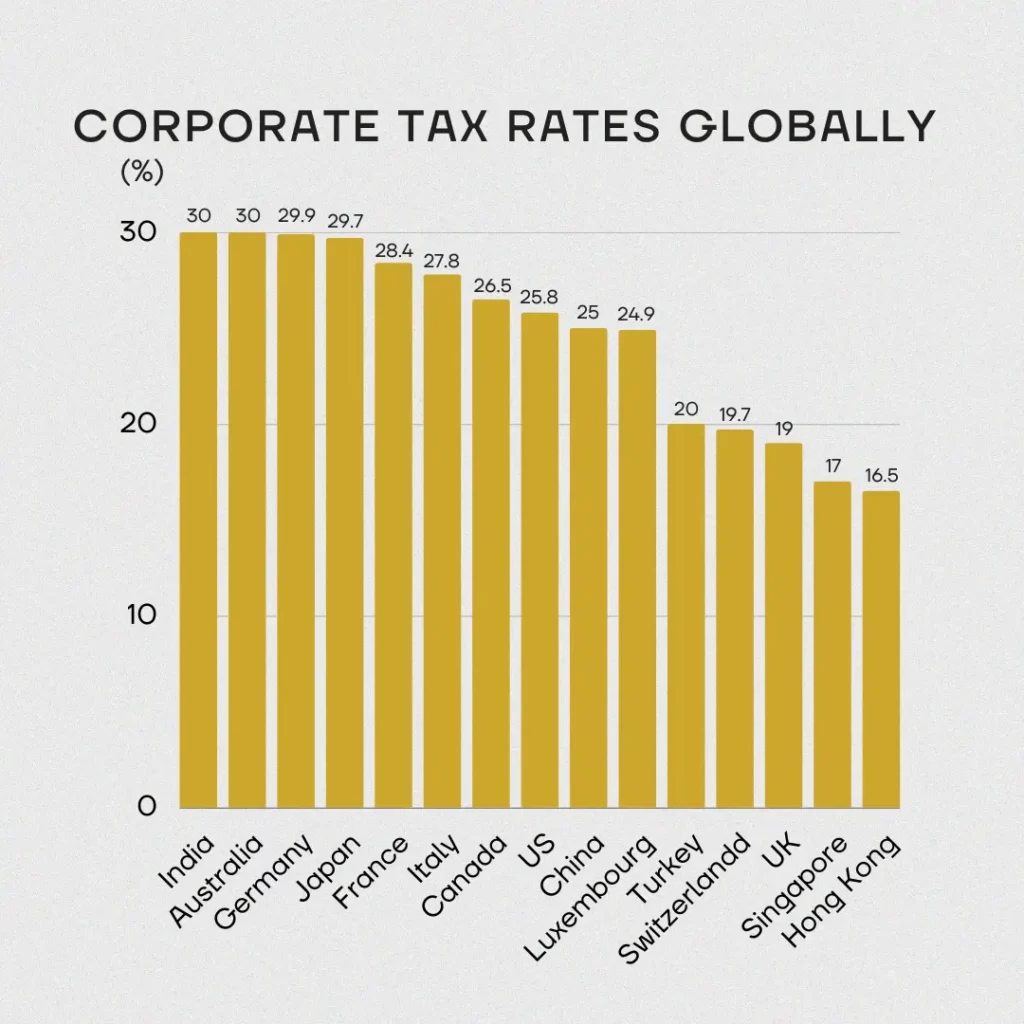

The UAE is known as a largely tax-free country. However, there are several taxes that businesses need to be aware of, such as:

- Value Added Tax (VAT): VAT is a 5% tax that is applied to most goods and services sold in the UAE. Businesses that sell goods or services that are subject to VAT are required to register for VAT and collect VAT from their customers.

- Corporate Income Tax: Corporate income tax is a 9% tax that is applied to the profits of businesses that are incorporated in the UAE. Businesses that are subject to corporate income tax are required to file an annual tax return and pay tax on their profits. However, certain businesses are subject to a 0% corporate income tax rate, including:

- Businesses with taxable income not exceeding AED 375,000

- Qualifying free zone persons with qualifying income

- Branches of foreign banks

The corporate income tax rate in the UAE is one of the lowest in the world, and it is expected to attract foreign investment and businesses to the country.

- Customs Duties: This applies to goods that are imported into the UAE. The rate of customs duty varies depending on the type of goods being imported.

- Excise Taxes: This is applied to specific goods, such as tobacco, alcohol, and energy drinks. The rate of excise tax varies depending on the type of good being taxed.

In addition to these taxes, businesses may also be subject to other taxes, such as municipal taxes and stamp duties. The specific taxes that a business is subject to will depend on the type of business and the activities that it engages in.

Solution:

It is important for businesses to understand the tax environment in the UAE and to comply with all applicable tax laws. Failure to comply with tax laws can result in penalties and fines.

HERE ARE SOME TIPS FOR BUSINESSES TO STAY COMPLIANT WITH TAX LAWS IN THE UAE:

- Register for VAT and collect VAT from customers (if required).

- File annual tax returns and pay tax on profits (if required).

- Declare all imports and pay customs duties (if required).

- Declare all excised goods and pay excise taxes (if required).

- Comply with all other applicable tax laws.

It is also a good idea for businesses to consult with a tax advisor to ensure that they are in compliance with all applicable tax laws.

IFZA is committed to supporting its Free Zone community in their compliance with the upcoming implementation of the Corporate Tax. It has partnered with Zoho One, a cloud-based platform which includes access to FTA-accredited tax accounting software, Zoho Books. Zoho Books facilitates business transactions, manages customers and vendors, issues tax-compliant documents, generates reports, and files tax returns effortlessly.

A number of IFZA Professional Partners also provide accounting services to support compliance of their clients.

BUSINESS SETUP CHALLENGE #4: UNDERSTANDING THE UAE JOB MARKET

Employing staff in the UAE comes with specific requirements, such as providing visas to employees before they can begin work.

- Visa quota: The number of visas that a business can sponsor is determined by the type of business and the jurisdiction in which it is registered.

- Visa requirements: To sponsor a visa, businesses must meet certain requirements, such as having a valid business license, providing a salary that is at least the minimum wage, and providing suitable accommodation or accommodation allowance for the employee.

Visa Process:

Employee/Employer Visas To live and work in the UAE, a visa is necessary. The visa application process involves several steps:

- Entry Permit: The process begins with applying for an entry permit from the Ministry of Labor. This will legally allow the employee to enter the UAE for up to 30 days and remain in the country for two months, with the possibility of two extensions. It is recommended to avoid leaving the UAE during the visa process.

- Status Change: Once you receive the permit, the next step is to get it activated. You can do this through either an in-country or out-of-country status change. The in-country change involves submitting your passport to immigration, who will stamp and activate your visa. Out-of-country change occurs when you present your permit to immigration upon arrival in the UAE.

- Medical Exam and Emirates ID: Next, you will need to complete a medical fitness test. This includes a blood test, fitness exam, and chest x-ray. Once everything is clear, you can then apply for the official Emirates ID card. This ID contains your personal information, such as your name, date of birth, and nationality. It also stores your visa information, so you can use it to travel in and out of the UAE.

In addition to the visa requirements mentioned above, businesses must also consider the following when hiring employees in the UAE:

Insurance:

Employers in the UAE are required to provide health insurance for their employees. This insurance must cover the employee’s medical expenses. It is important to note that it is the employee’s responsibility to apply for the Involuntary Loss of Employment Insurance (ILOE) scheme. This scheme provides financial support to employees who lose their jobs through no fault of their own.

Gratuity:

If an employee has served more than 5 years, he is entitled to full gratuity of 30 days’ salary for each year of work following the first five years. The amount of gratuity is calculated based on the employee’s salary and length of service. Employees in the UAE are also entitled to end of service benefits such as unpaid leave. This is typically paid out when the employee terminates their employment, either by their own choice or by the employer. The amount of end of service benefits is calculated based on the employee’s salary and length of service.

Other benefits:

Employers in the UAE may also provide other benefits to their employees, such as transportation, and education allowances for employees and dependents, bonuses and more.

Solution:

Regardless of the jurisdiction, it is important to familiarize yourself with the employment regulations to ensure compliance and smooth operations. Once you understand the core employment regulations, hiring and managing employees becomes more manageable

BUSINESS SETUP CHALLENGE #5: OPENING A CORPORATE BANK ACCOUNT

According to a 2022 report by the Economist Intelligence Unit, 50% of business owners in the UAE find it difficult to open a bank account. This is significantly higher than the global average of 25%. Another study conducted by the Dubai Chamber of Commerce highlighted that 65% of the entrepreneurs interviewed cited banking as their biggest challenge in company setup in the UAE. This sentiment is also echoed in a focused group study conducted by IFZA where 50% of the respondents mentioned that business owners find it challenging to open a corporate bank account due to lengthy application processes, difficulty in compliance or lack of information.

There are a number of factors that contribute to the difficulty of opening a corporate bank account in the UAE, including:

- Strict regulations:

Banks in Dubai are required to conduct a thorough due diligence process on their customers, including businesses. This process can take time as banks need to verify the authenticity of the documents submitted by the business. - Lack of transparency:

Banks in Dubai have their own internal policies and procedures, which may not be clear or transparent to customers. This can lead to delays and confusion. - High demand:

Dubai is home to a large number of businesses, both local and international, which are all vying for banking services. This high demand can put a strain on the banking infrastructure, leading to delays in processing applications and opening new accounts.

Solutions:

Fortunately, IFZA Professional Partners will soon have access to dedicated services that will enable IFZA Free Zone companies to have quick and convenient financial services.

There are a number of things that businesses can do to improve their chances of opening a corporate bank account in the UAE, including:

- Work with a reputable bank:

Businesses should work with a reputable bank that has experience of working with businesses in the region. The bank should be able to help the business understand the regulations and requirements, and they should be able to provide the necessary documentation and information. - Do your research:

Businesses should do their research before approaching a bank. This includes understanding the regulations and requirements, as well as the different banks that offer corporate accounts. - Be prepared:

Businesses should be prepared to provide the necessary documentation and information when they approach a bank. This will help the bank process the application more quickly.

Read more about opening a corporate bank account in the UAE here: A Business Owner’s Guide to Corporate Banking.

SET UP YOUR BUSINESS IN UAE’S MOST DYNAMIC FREE ZONE COMMUNITY

Setting up a business in the UAE may present its fair share of challenges. However, with proper planning, strategic execution, and the support of expert guidance, you can easily overcome these obstacles.

IFZA offers streamlined processes and a wealth of benefits, making business setup in the UAE a hassle-free endeavor. We have a team of business advisors or Professional Partners who can help you every step of the way. They can provide you with guidance on the legal, regulatory, and tax aspects of setting up a business in the UAE.

Embracing the opportunities available in the UAE, coupled with the right knowledge and support, can pave the way for your business to thrive in this dynamic and prosperous market.